Derry City and Strabane District Council agrees its budget for 2024/25 with a focus on capital investment

Derry City and Strabane District Council has today agreed its budget for the incoming 2024/25 financial year and set a District Rates increase for ratepayers. The rates increase struck by Council today of 6.50% will see an average rates bill increasing by £35.92 per annum or 69p per week. The regional rate, set by Central Government, will be determined by the end of March, and will have an impact on the overall rates bill.

The rates rise was set at a Special Meeting of Council today, Wednesday, February 14, 2024, where it was highlighted that while the financial challenges are not as significant as last year, a number of challenges remain for Council including high inflation rates at 4%, associated staff pay and cost of living pressures, global volatility, construction inflation, and risks to Central Government grants due to current NI Executive budgetary pressures.

The agreed 6.5% District rates increase is composed of a 3.17% increase to cover statutory pressures and inflation, 1.83% to offset Central Government grant cuts mainly to Rates Support Grant, and 1.50% rates investment into Council’s ambitious capital programme to allow the progression of its strategic leisure and further community projects across the District. In essence, had Council not had any growth ambitions and did not have to deal with the level of grant cuts (which are not faced by most other Councils), a sub-inflationary rates increase could have been achieved.

Council will continue to deliver a full suite of critical front-line services to ratepayers and has continued to have a clear focus on protecting jobs, statutory and core services, and funding to community organisations and arts and culture groups who rely on Council grant funding to deliver community services and projects. The new rates will also see service development with provision set aside to allow roll-out of brown bins in remaining rural areas.

Council has an exciting £420m ongoing programme of capital investment which has either been delivered or is in the process of being delivered across the District. Projects currently being progressed include the DNA Museum, Acorn Farm, Daisyfield Sports Hub, Derg Active, North West Greenways Network, the new West Bank Cemetery, Strabane Public Realm and the Melvin Boxing Facility and Sports Hall. Also included is a transformative £240m programme of City Deal/ Inclusive Future Fund investment and with Outline Business Cases currently being submitted to Government, it is hoped to secure a Financial Deal by Spring/ Summer 2024.

Building on this, the exciting message from this year’s rates process is that Council has earmarked 1.5% rates investment as part of an ambitious 6-7 capital financing strategy aimed at achieving over £210m of further capital investment. This will enable Council to progress its two transformative strategic leisure developments at Templemore and Strabane; new civic/commercial office development that forms a key component of the wider vision for future Central Riverfront development and university expansion plans; as well as continued investment in community projects across the District such as play parks/ greenways/ community centres/ waste facilities/ pitch development etc.

Elected Members were informed that the 1.5% rates investment as part of the 2024/25 rates process now enables Council to plan ahead with the intention of delivering its strategic leisure projects at Templemore and Strabane including progression to detailed design and consultation. The final financing decision including whether to proceed to tender will be officially concluded as part of the 2025/26 rates process.

Members at the meeting were informed that Council was striking its rates based on a number of significant estimates due to figures yet to be confirmed such as the national pay agreements for 2024/25, inflation forecasts and confirmation of Central Government grant funding for key services, regional rates increases and insurance tender exercises. For that reason, Council has retained funds within its Financial Contingency Reserves to mitigate against any of these budgetary risks.

The meeting heard how Council relies heavily on Central Government funding to fund many of its services including community and advice services, PCSP, Good Relations, CCTV, Animal Welfare, Labour Market Partnership and Peace Plus. Given that NI Executive budgets have not yet been agreed, there remains a risk that some of this funding may be cut given the budget challenges facing the NI Executive. Whilst there are ongoing challenges against PSNI CCTV grant cuts and regional animal welfare grant cuts initiated during 2023/24, the key challenge facing Council as the Council with the highest level of need relates to the ongoing and continued cuts applied to Rates Support Grant since Local Government Reform.

In conclusion, members in approving the agreed District rates increase will allow Council to continue to press ahead with its ambitious plans to drive growth and investment across the City and Region as well deliver critical front-line services across the City and District.

The new agreed District rate for the year ending 31st March 2025 will be 37.7408p in the £ for Non-Domestic properties and of 0.6070p in the £ for Domestic properties. This represents a 6.50% District rates increase for all ratepayers.

The Special Council meeting is available to watch back on the Council’s Youtube channel.

Rates Breakdown

The Councils estimated revenue expenditure (net of specific grant income and fees and charges from council services) in 2024/25 will be £78.044m.

Net Revenue Expenditure

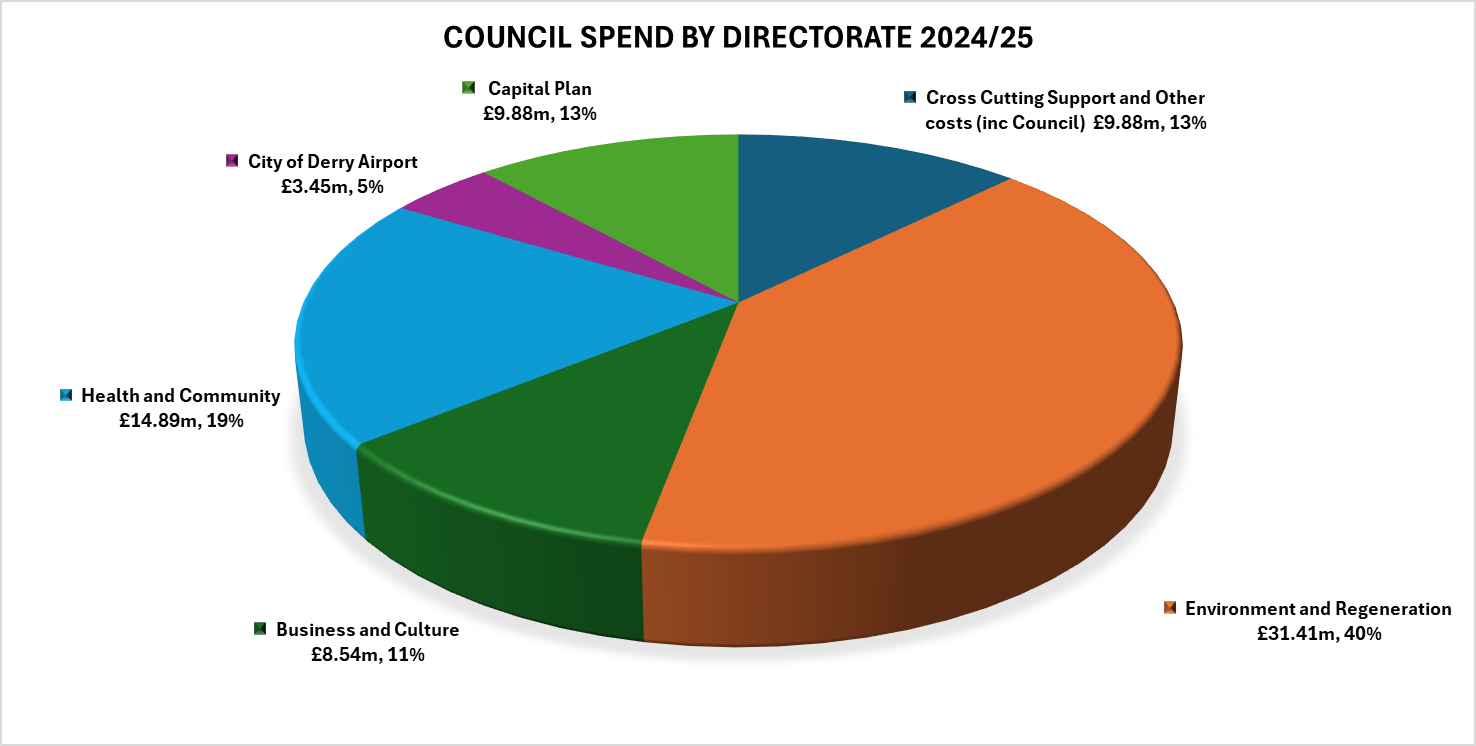

The following chart demonstrates how this money will be spent across each of our Service Directorates:-

|

Environment and Regeneration 40.24% |

£31.407m |

|

Health and Communities 19.08% |

£14.891m |

|

Business and Culture 10.94% |

£8.541m |

|

Capital plan 12.66% |

£9.881m |

|

City of Derry Airport 4.41% |

£3.445m |

|

Cross Cutting Support and other costs (incl Council) 12.66% |

£9.878m |

|

Total Net Expenditure |

£78.044m |

Total Income

For the financial year 2024/25, the net expenditure will be funded from the following sources of income-

|

|

£76.085m |

|

Rates support grant |

£0.619m |

|

Transferring functions grant |

£0.441m |

|

Reserves |

£0.900m |

|

|

|

|

Total income |

£78.044m |

Rates breakdown per household

The following table is based on the average property value and details what the average ratepayer in the Derry City and Strabane District Council will pay in 2024/25 compared to the N. Ireland Council average:

Domestic Ratepayer Examples Based on Average House Values

|

|

Derry City and Strabane |

NI Council Average |

|

|

|

|

|

Average Property Value (£) |

96,964 |

121,613 |

|

Average District Rate (£)- |

588.57 |

542.37 |

|

Average Regional Rate (£) |

488.89 |

613.17 |

|

Average Total Rates Bill for 2024-25 (£) |

1,077.46 |

1,155.54 |

|

|

|

|

|

|

|

|

|

|

|

|

This year’s District rates increase of 6.50% will mean an average increase of £35.92 per annum or 69p per week and will see the average domestic District rates bill increase to £588.57.

NON-DOMESTIC RATES

Non-domestic rates are a rate for all business properties, such as offices, factories and shops, with bills based on the rental value of your property as at March 2023..

Further information and the updated Non domestic valuation list can be found online at the attached link:-

https://www.finance-ni.gov.uk/news/reval2023-will-help-rebalance-business-rates

Non domestic ratepayers will also see District rates bills increase by an average of 6.50%.

There are a range of reliefs available to business ratepayers. These include the following:-

- Small Business Rate Relief

- Small Business Rate Relief for small Post Offices

- Charitable Exemption for rates

- Sports and Recreation Rate Relief

- Residential Homes Rate Relief

- Industrial Derating

- Non-Domestic Vacant Rating

- Hardship Rate Relief

- Rural ATMs

Of the 5,654 non domestic properties in this Council area, 15% of business ratepayers are fully exempt from rates; 65% are small businesses who can avail of small business rates relief ranging between 20% and 50% of their rates bills; and a further 7% avail of de-rating relief of between 70%-80% of their rates bills.

More details can be found at the attached link:-

https://www.nibusinessinfo.co.uk/content/help-available-business-rates

Rates 2024 25

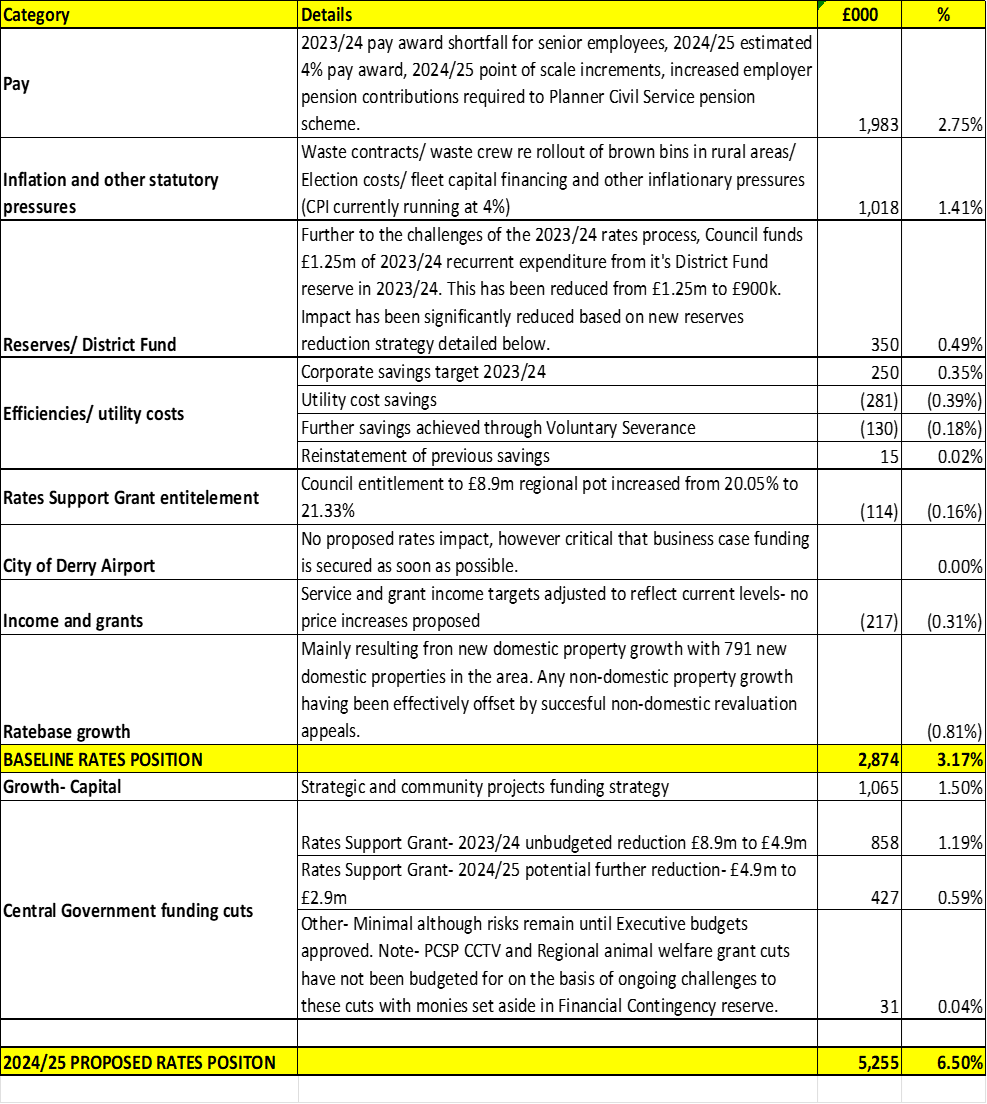

The 6.5% District rates increase has resulted from the following factors and impacts:-

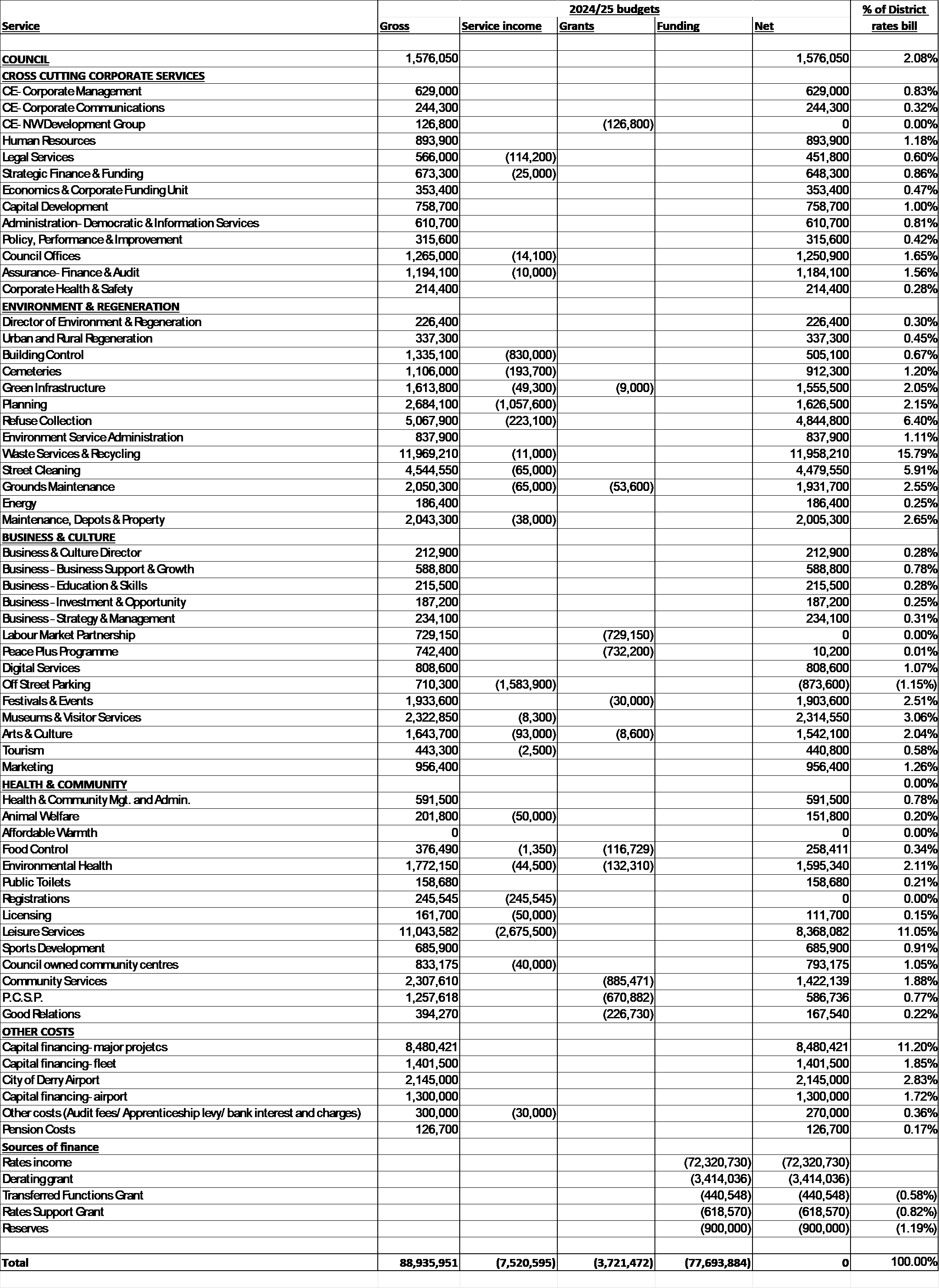

UPDATED SERVICE COSTS 2024 25

summary of costs and income for all Council service areas for 2024 25 is provided in the table below:-

when will I receive my rates bill for 2024-2025?

All ratepayers will receive their 2024-2025 rates bill, which is made up of the district rate (55%) and regional rate (45%) set by central government, from Land and Property Services. The date of issue will be confirmed by Land and Property Services in early April 2024..